ST Engineering 1H2025 Financial Statements, ST Engineering Results Presentation 1H2025

Singapore, 14 August 2025 - Singapore Technologies Engineering Ltd (ST Engineering) today reported its first half-year financial results ended 30 June 2025 (1H2025).

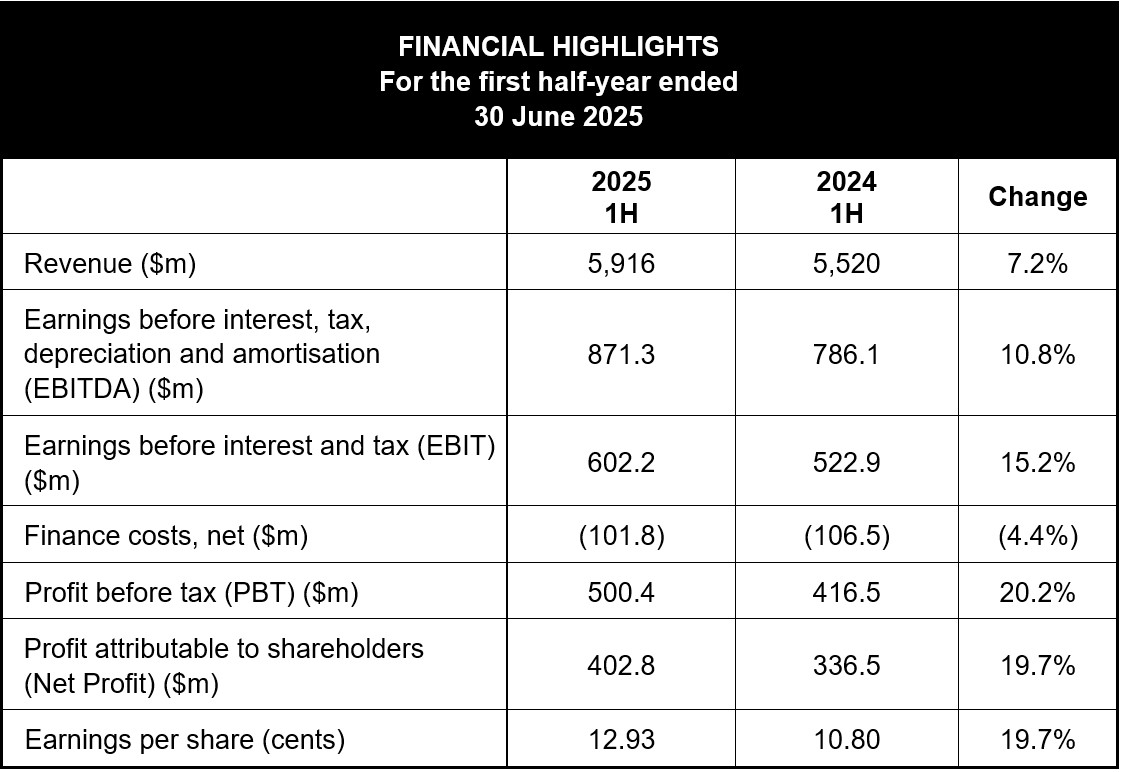

The Group delivered a strong revenue of $5.92b in the first half of 2025, rising 7% year-on-year (y-o-y) from $5.52b, driven by growth across all three business segments. Group EBITDA was $871m, up 11% y-o-y from $786m. Group EBIT increased 15% y-o-y to $602m from $523m, and Group Profit before tax (PBT) grew 20% y-o-y to $500m from $416m. Group Profit attributable to shareholders (Net Profit) rose 20% to $403m from $337m a year ago. Group revenue would have grown 8% if not for the forex translation impact of a weaker USD against SGD, while the forex translation impact on Net Profit was negligible.

Overall tariff impact on the Group’s first half results was immaterial after mitigation measures were implemented. In its Commercial Aerospace segment, $34m revenue, over 2.5 months in the second quarter, was deferred to the second half of 2025. This was lower than the previously anticipated revenue deferral impact of up to $40m per month.

Business Segments: 1H2025 Revenue and EBIT

Commercial Aerospace (CA): Revenue grew 5% y-o-y to $2.35b from $2.23b driven by higher revenues from Engine MRO and Nacelles, partially offset by lower PTF revenue. EBIT was $223m, up 18% y-o-y from $190m, contributed by higher revenue, better margin mix and cost savings.

Defence & Public Security (DPS): Revenue grew 12% y-o-y to $2.65b from $2.37b, contributed by all its sub-segments. EBIT increased 13% y-o-y to $367m from $324m as a result of higher revenue and cost savings.

Urban Solutions & Satcom (USS): Revenue was flat y-o-y at $921m as higher revenue from Urban Solutions sub-segment was offset by lower contribution from Satcom sub-segment. The segment posted an EBIT of $12m, up from $9m a year ago, helped by margin mix and cost savings.

“We delivered a robust set of results in first-half 2025. In executing our growth strategy, we continue to be agile in navigating the evolving global landscape.

Our recent divestments are in line with our portfolio rationalisation strategy to exit non-core business and recycle capital. We remain steadfast in strengthening our core businesses. Our strong order book continues to provide revenue visibility for the Group.”

Vincent Chong, Group President & CEO

New Contract Wins and Order Book

The Group secured $9.1b of new contracts for 1H2025, including $4.4b announced for 1Q2025. In 2Q2025, the Group won $4.7b in new contracts, comprising $1.5b for Commercial Aerospace, $1.5b for Defence & Public Security and $1.7b for Urban Solutions & Satcom.

With these contract wins, and after revenue delivery, ST Engineering ended 1H2025 with an order book of $31.2b as at 30 June 2025. The Group expects to deliver about $5.0b from the order book in the remaining months of 2025.

Interim Dividend

The Board of Directors has approved a 2Q2025 interim dividend of 4.0 cents per ordinary share. Shareholders will receive the payment on 5 September 2025.

Notes:

[1] Refers to Group revenue by products and services type.

*****

For further enquiries, please contact:

Lina Poa

Head Investor Relations

ST Engineering

Email: ir@stengg.com

For media enquiries, please write to us at news@stengg.com

Copyright © 2026 ST Engineering

By subscribing to the mailing list, you confirm that you have read and agree with the Terms of Use and Personal Data Policy.